Exploring the Impact and Opportunities of S&P 500 Equal Weight Index Options Launch in 2025

The Evolution of Options Trading in the S&P 500

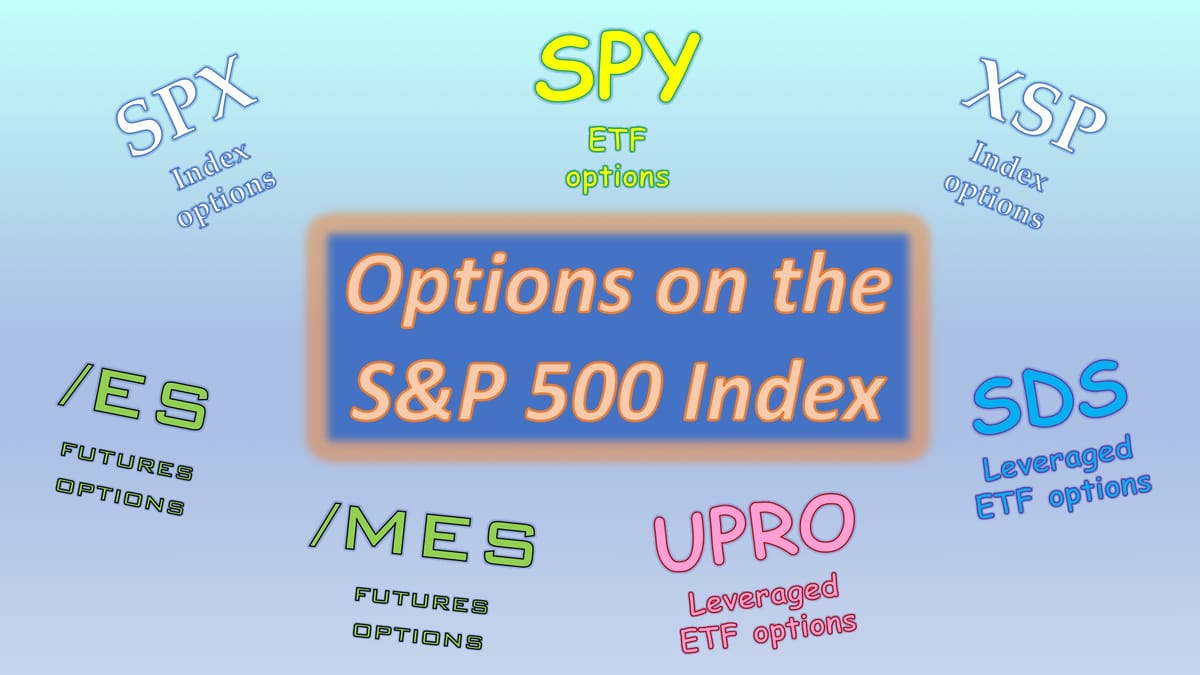

In the evolving world of financial trading, S&P 500 options have established themselves as invaluable tools for investors seeking to navigate market volatility effectively. The inception of S&P 500 Equal Weight Index (EWI) options in 2025 represents a significant step towards offering diversified strategies to mitigate concentration risks prevalent in traditional indices. Understanding these innovative financial instruments provides traders with strategic advantages amid geopolitical tensions and economic uncertainties. This development marks a significant moment as markets confront ongoing challenges.

Since their early days, S&P 500 options have played a pivotal role in the financial ecosystem by providing investors with mechanisms for managing risk and capitalizing on market dynamics. The official launch in January 1990 of options trading on the S&P 500 (SPX) was transformative, opening pathways for both hedging and speculative strategies among a broad spectrum of investors. This advent enabled a standardized approach to trading, enhancing both strategic planning and execution.

A defining feature of SPX options is their structure—cash-settled and European-style—which eliminates the early exercise risk and clarifies hedging strategies for traders. These attributes reduce complexities associated with physical delivery, ensuring clarity in strategic market maneuvers. As the market landscape has evolved, regulatory adaptations have furthered innovations in strategy, reflecting shifts in investor behavior and technological progressions.

Recent developments, such as the introduction of S&P 500 EWI options in April 2025, further diversify the trading landscape. With a contract multiplier of $100 and a notional value around $63,200 per contract, these instruments aim to enhance accessibility and ensure liquidity for market participants. This evolution underscores the broader range of tools available for engaging with the market, strengthening the S&P 500's status as a premier benchmark in large-cap equities.

The continual advancement of S&P 500 options is a testament to an era marked by dynamic innovation and adaptation, setting the stage for future developments in the derivatives market.

S&P 500 Equal Weight Index Options Unveiled

The launch of S&P 500 Equal Weight Index (EWI) options by Cboe on April 14, 2025, has expanded the gamut of S&P 500-related derivatives. These options are distinct due to their exposure to an equal-weighted iteration of the index, contrasting with the market-cap-weighted structure of the traditional S&P 500. The EWI options create a balanced exposure by assigning a fixed 0.2% weight to each constituent, rebalancing quarterly. This method provides more equitable sector representation, mitigating the bias toward larger companies typically perceived in conventional indices.

The contract specifications are crafted to support a wide array of trading strategies, ensuring the derivatives' accessibility and liquidity. These options promise a rich blend of opportunities, offering benefits of diversification and speculative flexibility. They are strategically advantageous, particularly for investors looking to enhance exposure without the concentration risks tied to larger market capitalizations.

Additionally, EWI options enrich existing strategies by including hedging or income generation through various tactics. Options strategies such as premium selling can leverage the EWI’s distinctive volatility profile—often different from that of lengthily weighted counterparts—encouraging traders to explore volatility arbitrage between EWI and traditional S&P 500 options.

Overall, these options introduce nuanced investment implications for those navigating the diversified terrain of U.S. equities, moving beyond traditional market-cap weightings.

Navigating Market Volatility with EWI Options

In today's complex economic climate, with geopolitical tensions and variable forecasts, the launch of S&P 500 EWI options presents a novel route to addressing market volatility. By maintaining equal weights, EWI options mitigate risk exposure to mega-cap stocks that dominate traditional indices. The options provide traders with considerable flexibility amid broader market fluctuations.

EWI options offer critical advantages for speculation and risk management, allowing traders to diversify within the index's diverse constituents. This diversification proves beneficial as the smaller-cap stocks therein often display divergent volatility patterns compared to their larger counterparts during economic instability or sector shifts.

The cash-settled nature of EWI options enhances their flexibility, allowing trades at one-tenth the index's value. This characteristic supports strategic positions requiring agile adjustments to market shifts, proving advantageous in volatile contexts. Income strategies, including covered calls, exploit the distinct volatility profiles of these options, making them suitable for revenue generation efforts.

In conclusion, S&P 500 EWI options equip traders with strategic frameworks to hedge specific risks and capitalize on volatility within less represented market sectors, ultimately empowering traders with robust market navigation tools.

Sector-Specific Strategies in Volatile Markets

Savvy traders focus on sector-specific strategies to capitalize on distinct performance traits under volatility. Defensive sectors like utilities and consumer staples remain attractive amid turbulent scenarios, sustaining stability due to their essential service provision regardless of economic fluctuations. This sectoral analysis allows traders to leverage stability without excessive risks associated with narrower, more volatile investments.

Strategies incorporating sector-specific options tap into these dependable sectors' resilience. Utilities consistently provide performance increments due to their indispensable nature. Meanwhile, consumer staples continue to see demand, making these strategic investments reliable against market downturns and encouraging diverse options strategies within an investor’s portfolio framework.

Utilizing sector-specific options can significantly enhance traders' position during volatile conditions. Implementing calls on utility sector ETFs or puts as hedges for less stable sectors showcases strategic versatility. Historical case studies have demonstrated reduced volatility for traders focused on consumer staples over correlations observed in purely cyclical investments.

Furthermore, international equities represent another avenue for diversification, with Latin American markets offering potential positive returns against shifting trade dynamics. By formally targeting exposure to specific sectors through options, traders can exploit these trends tactically.

Successfully navigating markets today demands nimble adaptability, reinforced by thorough sector performance analysis and dynamic strategy execution. It is essential to monitor market conditions continuously to enhance the risk-reward proposition.

The Future of Options Trading

The integration of artificial intelligence (AI) into options trading is transforming the industry, especially evident in 2025 trends pointing toward strategy optimization, extensive automation, and enhanced risk management. AI-driven tools are proficiently employed to analyze extensive datasets, identify market patterns, and recommend trades, thus refining decision-making accuracy. By utilizing historical data, AI systems optimize strategies such as iron condors or straddles, demonstrating notable performance upswing.

Automation is increasingly pivotal, with systems executing critical tasks like data collection, executing trades, and calculating risk parameters, including delta and gamma. These systems operate on pre-established rules sensitive to volatility changes and pricing models, mitigating human error and bias.

Real-time decision-making, enabled through AI, grants traders the ability to promptly adapt strategies, based on quickly analyzed market conditions. AI models are tuned to detect emergent trends for swift trade recommendations, amplifying traders' strategic prowess.

AI has vastly improved risk management by offering predictive insights on portfolio exposure, volatility-related calculations, and automating protective stop-loss or take-profit thresholds. However, challenges persist, such as potential mispredictions due to data quality, the inherent complexity of markets, and high maintenance costs associated with AI systems.

As options trading continues to evolve, the integration of AI highlights the necessity for human oversight in handling complex decisions beyond technological capabilities.

Conclusions

Against fluctuating economic backdrops, the introduction of S&P 500 EWI options represents an essential toolset for traders to diversify portfolios and manage risks effectively. This broadened capabilities spectrum, underpinned by evolving technologies and an astute grasp of market dynamics, offers rich strategic opportunities. Traders fortified with a deep understanding of these instruments, and who stay attuned to regulatory developments, are poised to maximize future opportunities and attain success in volatile market conditions.

Sources

- Historical Option Data - SPX Historical Data

- Cboe - Cboe Begins Trading in S&P 500 Equal Weight Index Options

- Nasdaq - SPX Historical Data

- S&P Global - S&P 500 Index

- Markets Media - Cboe Begins Trading SP 500 Equal Weight Index Options

- PR Newswire - Cboe Begins Trading in SP 500 Equal Weight Index Options

- The Trade News - Cboe Expands Options on SP 500 Equal Weight Index

- Hedge Week - Cboe Begins Trading in SP 500 Equal Weight Index Options

- Cboe Insights - Diversify Your Trading Portfolio with Cboe's S&P 500 Equal Weight Index Options

- BlackRock - Preparing Portfolios for Volatility

- Hartford Funds - 3 Strategies for Volatility

- Moneycontrol - Best Trading Strategies for Volatile Market

- iShares - Investment Directions Spring 2025

- iKnowFirst - Options Outlook Based on Artificial Intelligence Returns Up to 15.82% in 3 Days

- Maverick Trading - The Future of Options Trading

- Hyena.ai - How to Use AI for Options Trading

- Nasdaq - The Impact of AI on Stock Trading

- Options Trading - Top AI-Powered Tools for Options Trading